Once many Americans pay essential monthly bills (the mortgage or rent, utilities, car payment and insurance, health and dental insurance, gasoline, food, credit card bills, etc.) they don’t have a huge amount of money left over. People who live paycheck-to-paycheck, or who simply have significant financial responsibilities each month, understandably wish they could reduce their recurring monthly expenses.

If you’re in that situation, there’s one item on the aforementioned list that you can safely say goodbye to: dental insurance. In its place, say hello to a dental plan. If you assume you can’t afford to visit the dentist without insurance, think again! Dental plans make dental care affordable for all.

Dental Plans vs. Insurance

You already know the dental insurance drill: You pay a recurring monthly fee for “dental coverage” regardless of whether you end up going to the dentist that month or not. In addition to this monthly insurance premium, when you do go to the dentist you usually have to pay a copay out-of-pocket when you check out (or you’ll be billed later.) Dental insurance also caps the amount it will pay annually toward dental services (usually the amount is $1,000 or $2,000). Once your insurance has paid out the cap amount, you are responsible for paying 100 percent of any additional services.

Dental plans are membership-based discount plans – much like Costco and Sam’s Club. You pay a membership fee to gain access to discounted rates available only to plan members. Dental plans are smart because you only pay for services you’re actually getting. (Many insurance customers pay more in premiums than they receive in benefits.) Additionally, with dental plans, you don’t have to hassle with a third-party insurance company. Instead, you know in advance how much a dental visit will cost, and you pay the dentist for it directly. And, you can use the discounted plan rates as many times as you need to. There are no caps or limits.

How Does a Dental Plan Work?

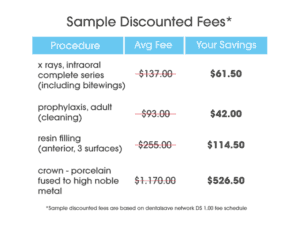

After you choose from various dental plans offered (for individuals, couples or families), you receive a membership number and a list of dentists who participate in the plan. Once you choose a dentist, you can make an appointment right away. The dentist’s office staff will be able to tell you the regular cash-pay price for the service you need, and then the lower price you will pay with your dental plan. Exact discounts vary, but typical savings range from 25 percent to 50 percent off of a dentist’s cash-pay, non-insurance price.

Here are some examples of how much dental plans could save you:

Dental plans are transparent, simple and can save you a tremendous amount of money on your oral care (and by eliminating dental insurance premiums).

Begin Saving – Now!

Whether you have been putting off your routine dental checkups or need (or suspect you need) dental work, you’re risking your oral health. Addressing decay, gum disease or damaged teeth early can prevent problems from becoming more serious and requiring expensive root canal therapy, crowns or extractions.

Dental plans are designed to make visiting the dentist without insurance affordable for all. DentalSave offers tiered discount dental plan options to appeal to singles, couples and families of all income levels. Find your plan, find your dentist, book your appointments and breathe a sigh of relief that you’re finally able to address your oral health.